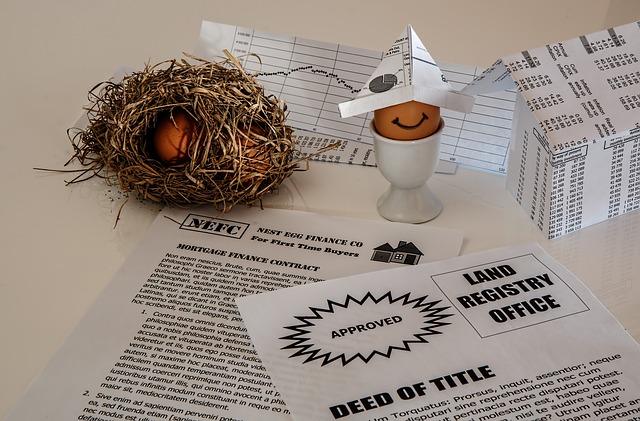

Getting a mortgage taken out on your home is something that’s important, and necessary to really care for. Proceeding without proper information is a recipe for disaster. While you are getting your loan, if you have questions about the process, keep reading this article.

Set your terms before you apply for a home mortgage, not only to prove that you have the capacity to pay your obligations, but also to set up a stable monthly budget. This means that you should set an upper limit for what you’re willing to pay every month. When your new home causes you to go bankrupt, you’ll be in trouble.

Create a budget so that your mortgage is no more than thirty percent of your income. This will help insure that you do not run the risk of financial difficulties. Manageable payments leave your budget unscathed.

It’s a wise decision to make sure you have all your financial paperwork ready to take to your first mortgage lending meeting. Showing up without the proper paperwork will not help anyone. Your lender will need to see this necessary information, and having it on hand will help speed up the process.

Credit Rating

You should have good credit in order to get a home loan. Almost all home lenders will look at your credit rating. They do this because they need to know that you are someone they can trust to pay the loan back. A bad credit rating should be repaired before applying for a loan.

Prior to speaking to a lender, get your documentation in order. The lender is going to need income proof, banking statements, and other documentation of assets. When you have these ready in advance and organized, then you are going to speed up the application process.

Do not go on a spending spree to celebrate the closing. Lenders often recheck credit a few days before a mortgage is finalized, and may change their minds if they see too much activity. Any furniture buying, as well as any other expensive item or project, needs to wait until your mortgage contract is signed and a done deal.

Think about paying an additional payment on you 30 year mortgage on a regular basis. Anything extra you throw in will shave down your principal. Making extra payments will help reduce the amount of interest you pay over the lifetime of the loan and this can help pay your loan off quicker.

You should learn as much as you can about the type of mortgage you will need. There are a wide variety of loans that are available. If you understand each, you’ll know which fits your needs the best. Your lender is a great resource for information about the different mortgage loan options.

Having read this article, you know more now about home mortgages than you did previously and are perhaps considering the next step. Apply this advice to make the process easier. All you have to do now is locate a lender and use this information.

Know what terms you want before you apply and be sure they are ones you can live within. Set a monthly payment ceiling based on your existing obligations. Stay out of trouble by only getting a mortgage you can afford.

There are tremendous opportunities for small businesses and social entrepreneurs to support their communities through community foundations, donor advised funds and other means of giving back. Find the neighborhoods in

Greene County, Missouri where you can make the most impact on the environment in the community.