House hunting is great fun, but the mortgage process is stressful. There are a number of requirements that must be met, and this article is loaded with information to inform you on the essential tips you need to know. Continue reading for helpful mortgage tips that anyone can use.

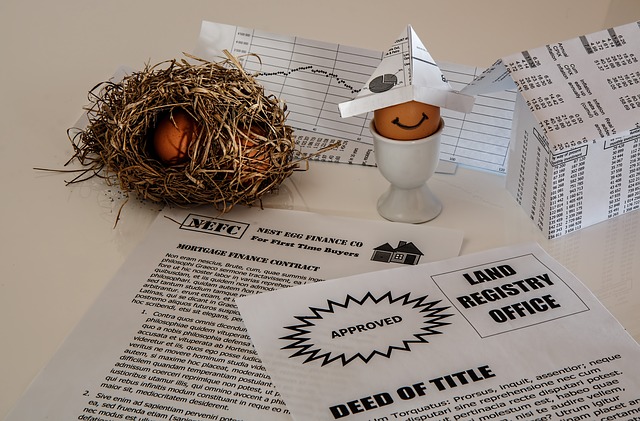

Start the process of taking out a mortgage way ahead of time. Get your finances in line before beginning your search for a home and home loan. That means building up a nest egg of savings and getting your debt in order. If you are not in good financial shape when you apply for a mortgage, you will likely be turned down.

Try getting yourself pre-approved for loan money, as it will help you to better estimate the mortgage payment you will have monthly. You should compare different loan providers to find the best interest rates possible. This will help you form a budget.

Start early in preparing yourself for a home loan application. Get your budget completed and your financial documents in hand. This ultimately means that you should have savings set aside and you take care of your debts. Hesitating can result in your home mortgage application being denied.

Before you try and get a mortgage, you should go over your credit report to see if you have things in order. In 2013 they have made it a lot harder to get credit and to measure up to their standards, so you have to get things in order with your credit so that you can get great mortgage terms.

There are new rules that state you might be able to get a new mortgage, and this applies even though you might owe more on your home that what it is worth. Prior to the new program rules, homeowners would apply and get denied for a new mortgage. Look into it and see how it can benefit your situation, by leading to lower mortgage payments and a better credit position.

If you are underwater on your home and have made failed attempts to refinance, give it another try. A program known as HARP has been modified, allowing a greater number of homeowners to refinance. Lenders are more open to refinancing now so try again. If your lender says no, go to a new lender.

Before applying for a mortgage, have a look at your credit report to make sure everything is okay. Credit requirements grow stricter every year, and you may need to work on your score before applying for a mortgage.

Most people have to endure the stressful process of applying for a mortgage in order to purchase a home. But, the process need not be stressful, as long as there is a knowledge base in place. Applying the advice in this piece can get you on the right path.