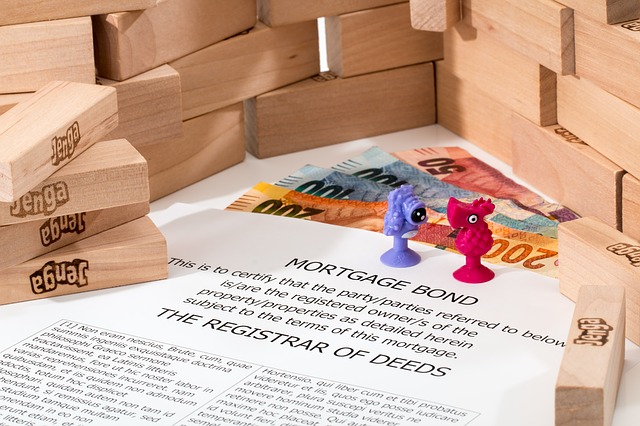

It is a common dream to own a home. Being a homeowner is one of life’s sweeter moments. To buy a home, almost everyone must obtain a mortgage loan. There are things you must know if you’re in the market for a mortgage. Keep reading for the right information.

Don’t be tempted to borrow the maximum amount for which you qualify. Lenders give you an approval amount, but they do not always have all the information about what you need to be comfortable. You must take some time to think about how you approach and spend money, what is going on in your financial life now and could be going on later.

When you are applying for a home loan, pay off your other debts and do not add on new ones. The lower your debt is, the higher a mortgage loan you can qualify for. High levels of consumer debt can doom your application for a home mortgage. If you carry too much debt, the higher mortgage rate can cost a lot.

Try getting a pre-approved loan to see what your mortgage payments will be monthly. Shop around to see how much you are eligible for so you can determine your price range. You will be able to figure out what your monthly payments will be by doing this.

Credit Report

Quite a while before applying for your loan, look at your credit report. The past year has seen a tightening of restrictions on lending, and you will need to ensure that your credit report is excellent to help you secure favorable mortgage loan terms.

Get all of your paperwork in order before seeking a home loan. Showing up to the bank without your most recent W2, work payment checks, and other income documentation can lead to a very short first appointment. The lender will want to see all of this material, so having it handy can save you another trip to the bank.

Avoid borrowing the most you’re able to borrow. The mortgage lender will tell you how much of a loan you qualify for, but that is not based on your life–that is based on their internal figures. Consider your lifestyle and spending habits to figure what you can truly afford to finance for a home.

If there are changes to your finances it can cause a delay or even cause the lender to deny your application. If your job is not secure, you shouldn’t try and get a mortgage. You should not accept a different job until your mortgage has been approved since your mortgage provider will make their decision depending on the information you included in your application.

In conclusion, you now have some tips to assist you in picking out a home mortgage. Use all of the information you learned here. Then, you can have a better understanding of home mortgages and make better decisions when it comes to owning a home of your own.