There are a lot of individual steps involved in securing a good mortgage. The first thing you have to do is learn all about mortgages in general. That starts with the following paragraphs and the useful knowledge within them.

Getting a mortgage will be easier if you have kept the same job for a long time. A two-year work history is often required to secure loan approval. Switching jobs too often can cause you to be disqualified for a mortgage. Also, you shouldn’t quit your job if you’re trying to get a loan.

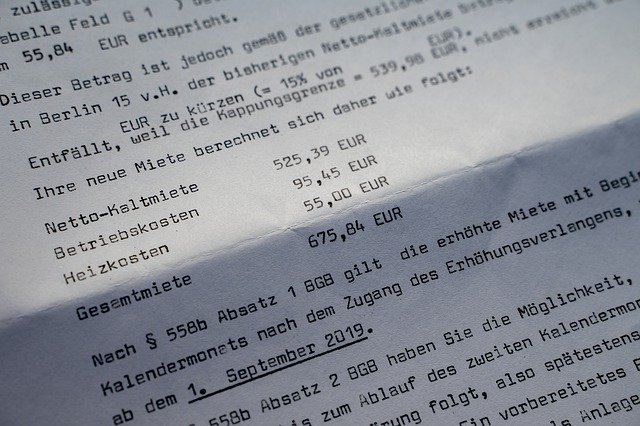

Get your financial documents in order. Many lenders require these documents. Income tax returns, W2s, bank statements and pay stubs are usually required. Having these documents ready will ensure a faster and smoother process.

HARP has changed recently so that you can try to get a new mortgage. This even applies for people who have a home worth less than what they currently owe. After the introduction of this new program, some homeowners were finally able to refinance. See how it benefits you with lower rates and better credit.

If you are buying your first home, find out if government assistance can help you get a good mortgage. You can find programs through the government that will help lower closing costs, and lenders who may work with people who have credit issues.

Before talking to a mortgage lender, organize your financial documents. A lender will want to see bank statements, proof of assets, and proof of income. If you have what you need before you go, you will get approved much quicker than you would have otherwise.

Before you buy a home, request information on the tax history. Prior to agreeing to a mortgage, you must understand your likely property tax bill. Sometimes property taxes are a lot higher than you may imagine at first. This can turn into a real surprise.

Don’t spend too much as you wait for approval. If a lender notices lots of charging activity before your mortgage is a done deal, they could change their mind about lending to you. Wait until the loan is closed to spend a lot on purchases.

Figure out the mortgage type you need. Learn about the various types of loans. When you know the various kinds, you can compare and contrast them so that you are sure to get the best fit for your own needs. The best person to ask about this is your lender. The lender can explain your options.

Adjustable rate mortgages, also known as ARM, don’t expire when the term is up. The rate is adjusted to the applicable rate at the time. This means the mortgage could have a higher interest rate.

Now that you know a thing or two, you can start to look for a good home mortgage. You can find a lender that will offer you what you need. Whether you’re looking for your first mortgage or another one, you have the tips you need to find the best mortgage for your needs.

There are some government programs for first-time home buyers. There are programs to help those who have bad credit, programs in reducing closing costs, and ones for lowering your interest rate.