It can be overwhelming to take on a mortgage. In order to make the best decisions, you should be educated. Use the great information in this article to get you headed in the proper direction.

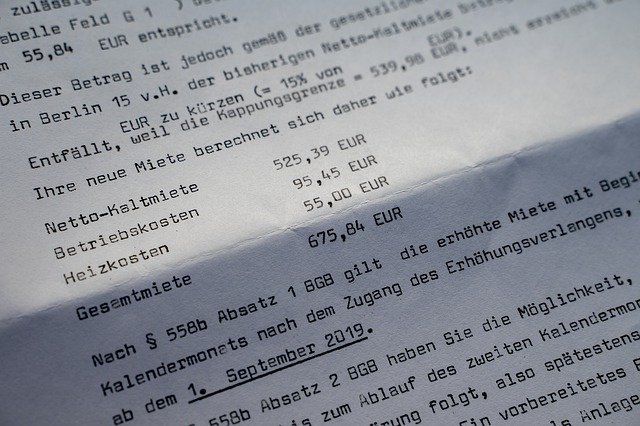

Gather your documents before making application for a home loan. Most lenders will require basic financial documents. W2 forms, bank statements and the last two years income tax returns will all be required. The whole process goes smoother when you have these documents ready.

Balloon mortgages are often easier to obtain. The loan is short-term, and you need to refinance the loan upon its expiration. These loans are risky because you may not be able to obtain financing when the balance comes due.

It’s a wise decision to make sure you have all your financial paperwork ready to take to your first mortgage lending meeting. If you go to a bank without necessary paperwork such as your W2 or other income documents, you will not get very much accomplished. The bank needs to see every one of these documents. Make sure you bring them when you go to your appointment.

Adjustable rate mortgages don’t expire when their term is up. However, the rates adjust to the current rate. The risk with this is that the interest rate will rise.

Your mortgage doesn’t just have to come from banks. Family could be a cheap source of a loan, for example. Credit unions can sometimes offer better interest rates than traditional lenders. When you are looking for you home mortgage loan, take all your options into consideration.

Lower your number of open credit accounts prior to seeking a mortgage. Carrying a ton of credit cards, even if there is no debt being carried there, can make you look like a risk to the lender. You will get better rates on your mortgage if you have a small number of credit cards.

New rules of the Affordable Refinance Program for homes may make it possible for you to get a new mortgage, whether you owe more on home than it is valued at or not. These new programs make it a lot easier for homeowners to refinance their mortgage. Check the program out to determine what benefits it will provide for your situation; it may result in lower monthly payments and a higher credit score.

Be sure to be totally candid when seeking a mortgage loan. If you are dishonest, it could result in your loan being denied. Lenders can’t trust you with money if they can’t trust the information to supply.

There are many things to understand in terms of mortgages. With this information, you should be more informed. Use these tips when you want to get a mortgage to ensure the best deal.