Are you thinking about purchasing a new home but have reservations about being able to pay for it? Are you unfamiliar with the various home mortgage options that are available to you? It doesn’t matter why you’re here. You can use these tips to get the best deal possible.

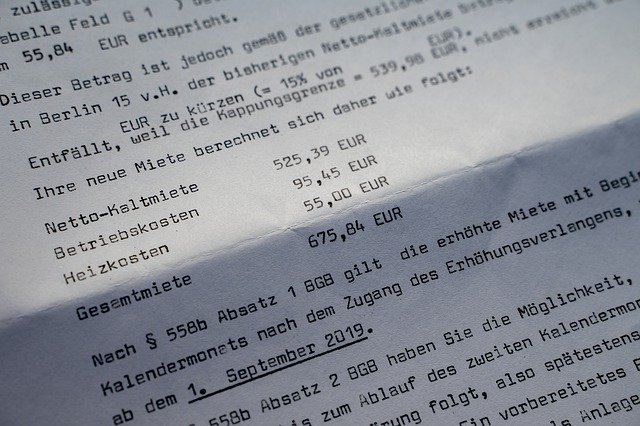

Get all your paperwork together before applying for a loan. If you do not have the necessary paperwork, the lender cannot get started. This paperwork includes W2s, paycheck stubs and bank statements. The lender will want to see all of this material, so having it handy can save you another trip to the bank.

When waiting to get word of approval, try not to incur additional debt. If a lender notices lots of charging activity before your mortgage is a done deal, they could change their mind about lending to you. Make large purchases after the mortgage is signed and final.

When trying to figure out how much your mortgage payment will be each month, it is best that you get pre-approved for the loan. This will help you determine a price range you can afford. This will help you form a budget.

You will most likely have to pay a down payment when it comes to your mortgage. Certain lenders give approvals without a down payment, but that is increasingly not the case. Consider your finances carefully and find out what kind of down payment you will need to provide.

Gather all needed documents for your mortgage application before you begin the process. Most lenders will require you to produce these documents at the time of application. You should have your tax returns, W2s and bank statements. When you have these papers on hand, the process will proceed quicker.

Clean up your credit before applying for a mortgage. Lenders will check your credit history carefully to determine if you are any sort of risk. If your credit is bad, do everything possible to fix it to give your loan the best chance to be approved.

Have your financial information with you when you visit a lender for the first time. Having the necessary financial documents such as pay stubs, W2s and other requirements will help speed along the process. Your lender will need to see all these documents. Bringing this paperwork with you during your first meeting will help you save time.

Do not give up if you had your application denied. Just move on and apply for the next mortgage with another lender. Every lender has different criteria for being qualified for a loan. This is why it’s always a good idea to apply with a bunch of different lenders to get what you wanted.

If you are buying a home for the first time, look into different programs for first time home buyers. There may be government programs to help you find lenders when you have a poor credit history or to help you secure a mortgage with a lower interest rate.

The tips here have provided you with the knowledge you need to seek out a new mortgage. It is possible for almost anyone to become a homeowner with the right loan. Remember these tips as use them wisely as you search for your dream home.

There is a program available that could help you get a new home loan, despite the fact that your home has fallen in value, and you owe more than the home’s worth. This new program allowed many previously unsuccessful people to refinance. Check it out and see if it can help you.