Owning a home is a dream for many people. It really is a source of pride. When buying a home, most need to take a mortgage out. The article below tells you what you need to know before you apply.

Don’t borrow the maximum offered to you. The mortgage lender is going to let you know how much you can qualify to get, but you shouldn’t think that’s a number based on how you’re living. Consider your life, how your money is spent, and what you can afford and stay comfortable.

Gather your paperwork together before applying for a mortgage. If you bring your tax information, paychecks and info about debts to your first meeting, you can help to make it a quick meeting. Lenders will surely ask for these items, so having them at hand is a real time-saver.

Any changes to your financial situation can cause your mortgage application to be rejected. Make sure your job is secure when you apply for your mortgage. Wait until after the mortgage is approved to switch jobs if that’s what you want to do.

If your home is not worth as much as you owe, and you have tried to refinance to no avail, try again. Recently, HARP has been changed to allow more homeowners to refinance. Speak to a lender now since many are open to Harp refinance options. If a lender will not work with you, go to another one.

Don’t spend too much as you wait for approval. Your lender may recheck your credit as a final step in your mortgage approval. Excessive spending may cause your loan to be disapproved. Wait until the loan is closed to spend a lot on purchases.

Gather financial documents together before making your loan application. Most mortgage lenders ask for similar documentation. They include bank statements, W2s, latest two pay stubs and income tax returns. If you have the documents in hand, you won’t have to return later with them.

Make sure that you do not go over budget and have to pay more than 30% of your total income on your house loan. Taking out a mortgage that eats up an excessive amount of income often leads to serious financial difficulties. Manageable payments are good for your budget.

Property Taxes

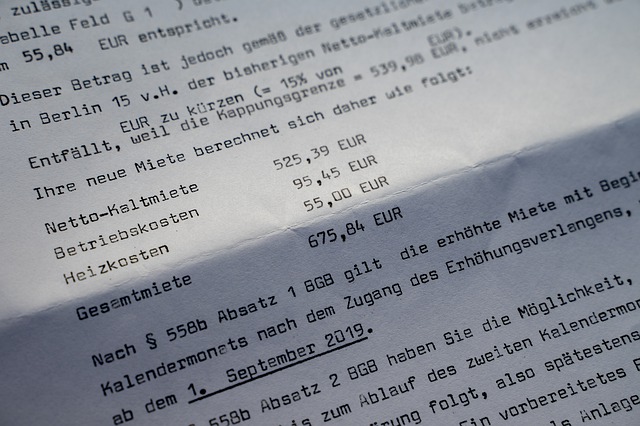

Find out the property taxes before making an offer on a home. This is important because it will effect your monthly payment amounts since most property taxes are taken from escrow. You don’t want to run into a surprise come tax season.

Look into interest rates and choose the lowest one. The bank’s goal is to lock in the highest rates they can. Don’t let yourself be a victim of this. Take the time to compare the interest rates offered by different banks.

There are several good government programs designed to assist first time homebuyers. There may be government programs to help you find lenders when you have a poor credit history or to help you secure a mortgage with a lower interest rate.

In conclusion, you now have some tips to assist you in picking out a home mortgage. Put the solid advice in the article above to use to help smooth your way. That will ensure you get great rates and terms.